Pvilion Blog | March 24, 2023 | By Julia Fowler

About the Federal Solar Investment Tax Credit

The Investment Tax Credit (ITC) originated from the Energy Policy Act of 2005. Although it was originally set to end in 2007, its success in promoting the shift to renewable energy in the United States led to many extensions over the past several years.

Most recently, the Inflation Reduction Act was signed by President Biden in August of 2022, extending the ITC for the next ten years. This means that businesses can continue to benefit from a 30 percent tax credit until 2032. The tax credit will remain available at 26 percent in 2033 and 22 percent in 2034.

According to a statement released by the White House regarding the enactment of The Inflation Reduction Act, it is believed that 950 million solar panels are expected to be in operation in the United States by the year 2030. The effects of this, paired with other clean energy initiatives in the bill, should “reduce greenhouse gas emissions by about 1 gigaton in 2030, or a billion metric tons,” according to the release.

How the Federal Solar Investment Tax Credit Works

The ITC applies to both commercial and residential solar investments. Users must own the entire solar energy system to be eligible for the tax credit. Although the ITC is not refundable, the remaining credit can be applied the following years for as long as the ITC remains in effect if the tax credit value is greater than the user’s tax liability at the time of purchase.

How Do Tax Credits Work?

Tax credits are tax incentives that allow for reduction in the taxes that companies and individuals owe to the federal government. This means 30 percent of the amount invested in a solar product can be subtracted from owed taxes.

Additional Information

There is an exception for organizations that do not pay federal taxes (i.e. local government, nonprofits, etc.). Certain tax-exempt organizations may be allowed to receive a refund from the IRS for applicable solar projects. Pvilion will help you receive this credit, and can offer leasing and financing options as well.

The solar ITC should be claimed when filing annual federal tax returns. If you or your business have an accountant that files for you, it’s important to inform them about the purchase of any solar products so that they may help you file accordingly.

How Does this Apply to Pvilion Products?

Pvilion provides turnkey solar products that are eligible for a 30 percent Solar Federal Investment Tax Credit (ITC). That means that the 30 percent ITC applies to nearly 100 percent of your Pvilion solar product order. This includes the cost of the entire structure and energy storage system, as well as all labor and permitting for installation, all hardware and equipment, and applicable sales tax.

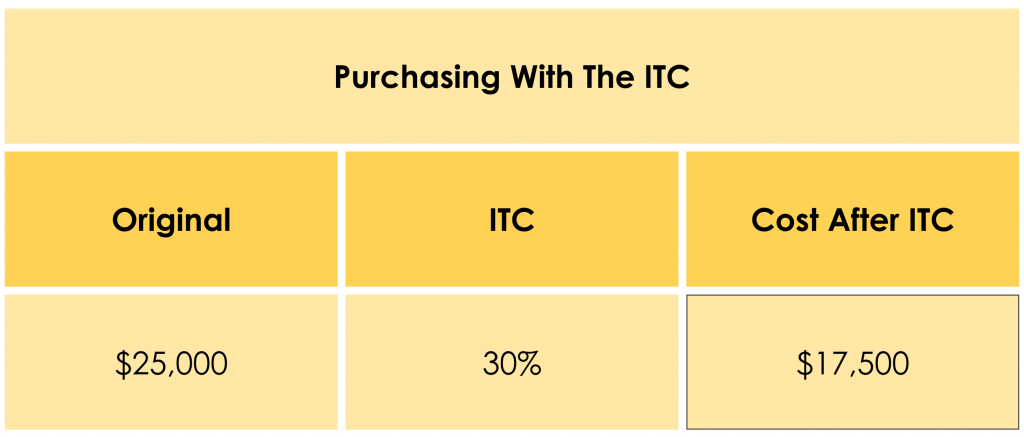

For example, a $25,000 Pvilion Solar Sail installation will get you a $7,500 ITC, which is a one-to-one tax credit. Therefore the installation will only end up costing you $17,500! That’s before any state and local incentives too.

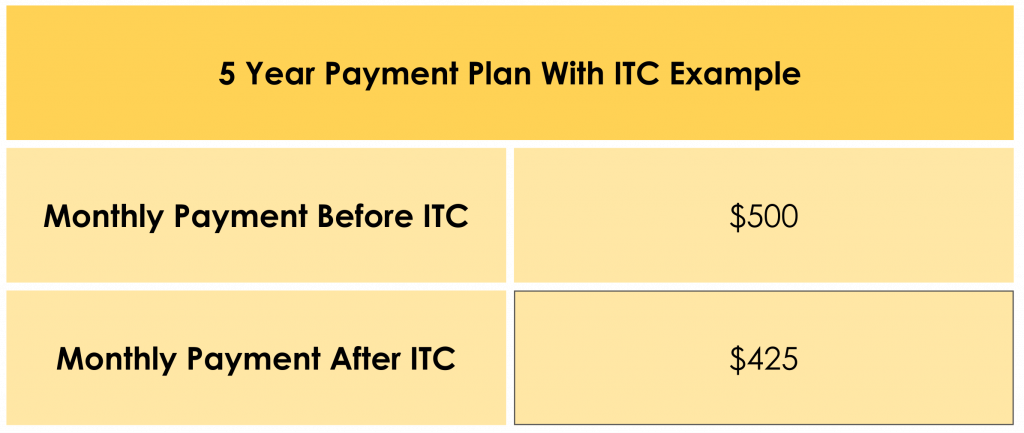

If you don’t have a tax bill (startup company, non-profit, municipality), don’t worry. We offer leasing and financing options for our products that will allow that tax credit to be passed through to you.

Disclaimer: This post was prepared for informational purposes only and is not intended to be used as financial or tax advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Want to learn more about how Pvilion Solar Canopies can transform your outdoor space? Get in touch with our solar fabric experts to learn more and receive a free quote.

news + press

news + press